News

Apple misses out on big 2024 smartphone market rebound, IDC says

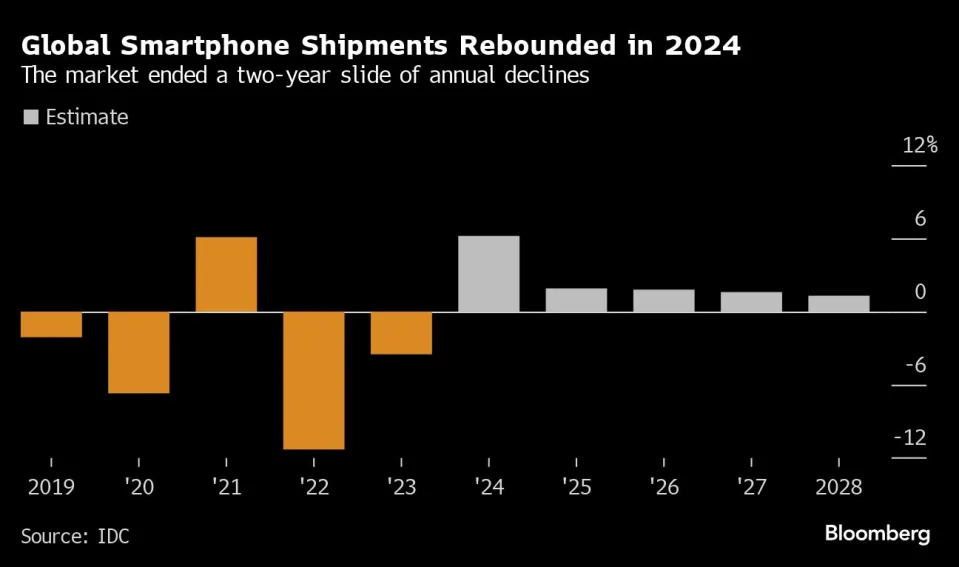

(Bloomberg) — Global smartphone sales rebounded strongly in 2024 after two successive years of decline, but Apple Inc. ( AAPL ) barely managed growth, an independent study showed, underscoring the speed with which Android-based rivals are gaining ground in China and emerging markets.

Apple and its rivals will ship 6.2% more phones or an estimated 1.24 billion units in 2024, according to market tracker IDC. But iPhone volumes likely edged just 0.4% higher. Still, Apple remains by far the profit leader with an average selling price surpassing $1,000, while Android rivals collectively came in at around $295, IDC estimates.

The latest study highlights the uneven recovery of the smartphone market, which slumped in the post-Covid era despite the advent of AI. Much of that 2024 growth came from pent-up demand and regions with lower smartphone penetration, IDC said. More affordable devices from Android vendors helped Chinese brands better capture that opportunity, while Apple is forecast to fare better next year.

The addition of artificial intelligence enhancements, a big theme among the likes of Samsung Electronics Co. ( 005930.KS , SSNLF ), Apple and Alphabet Inc.’s ( GOOG , GOOGL ) Google, failed to excite consumers.

“While GenAI continues to be a hot topic and top priority for many vendors, it is yet to impact demand significantly and drive early upgrades,” said Nabila Popal, research director at IDC. “More investments are needed to increase consumer awareness and introduce a ‘must have’ feature that will rush consumers to the store and create that super cycle which everyone is waiting for.”

Brands like Xiaomi Corp. ( XIACY , 81810.HK ) and Huawei Technologies Co. are pouring investment into hardware and designing their own processors — in a bid to mitigate the threat or effects of US sanctions while customizing their designs for AI use cases. Huawei on Tuesday introduced its latest smartphone powered by its made-in-China chips, while Xiaomi is preparing an in-house semiconductor for 2025 devices.

In China’s highly competitive market, where a half-dozen companies trade the top spot each quarter, large and prolonged discounts stimulated sales. Those had more of an effect than in the previous year, though concern about the country’s ailing economy is likely to persist.

Globally, shipments have yet to return to pre-pandemic levels, and IDC doesn’t expect anything more than low-single-digit growth for years to come. Lengthening times between upgrades, market saturation in developed economies and a rapidly growing trade in used smartphones are seen as the major factors contributing to stagnation.

—With assistance from Gao Yuan.