News

The vintage year for US stock markets that few people expected

(Bloomberg) — A year ago, equity investors and strategists braced for a potential turbulent 2024, worrying about the risk of a hard landing for the US economy and interest rates cuts that could come too late to prevent it.

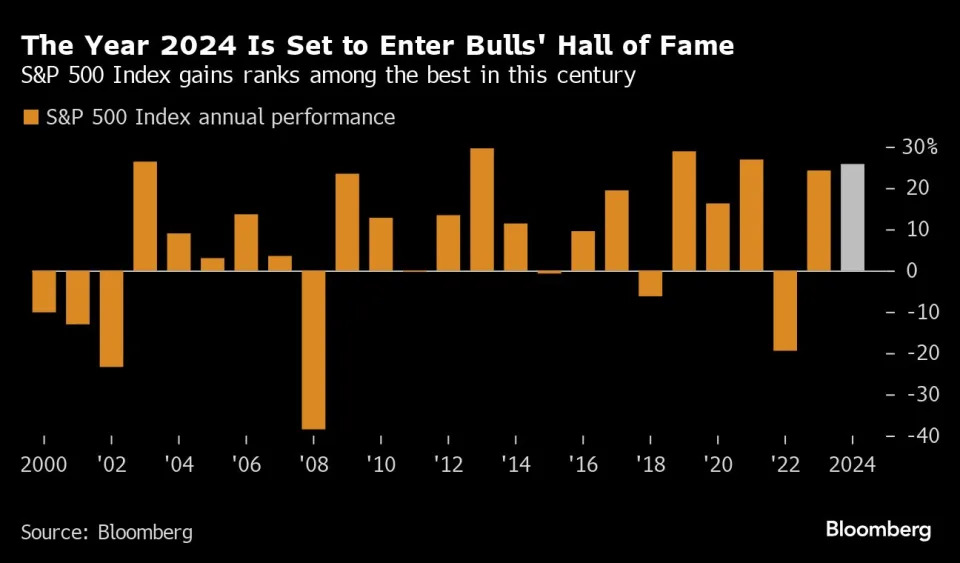

Fast forward to now: 2024 is set to enter Wall Street’s hall of fame of bull years.

Heading into the year, few anticipated that the S&P 500 ( ^GSPC ) Index’s annual gain would be among the best in history. Not many expected another blistering rally fueled by a handful of tech titans and a market sentiment so bullish that one risk event after another got cleared without a scratch.

In late 2023, a slowdown was the central scenario for a lot of economists and inflation was still a major concern, blurring the path for monetary policy and the outlook for corporate profits. But interest rates have come down, growth is still robust and earnings are rising, pushing the market higher and volatility has remained subdued despite a flurry of risk events.

The yearly performance of the Nasdaq 100 ( ^NDX ) and the S&P 500 is closer than it was historically, with both benchmarks up more than 20%. Artificial intelligence poster child Nvidia Corp. ( NVDA ) tripled once again in 2024, and all things technology followed in its wake.

Following an already great 2023, not a lot of market participants would have thought that this year could see a repeat. “There has been an extraordinary equity run – particularly in the US,” said William Davies, global chief investment officer at Columbia Threadneedle Investments. “Economic growth in the US has been solid and inflation has steadily decreased.”

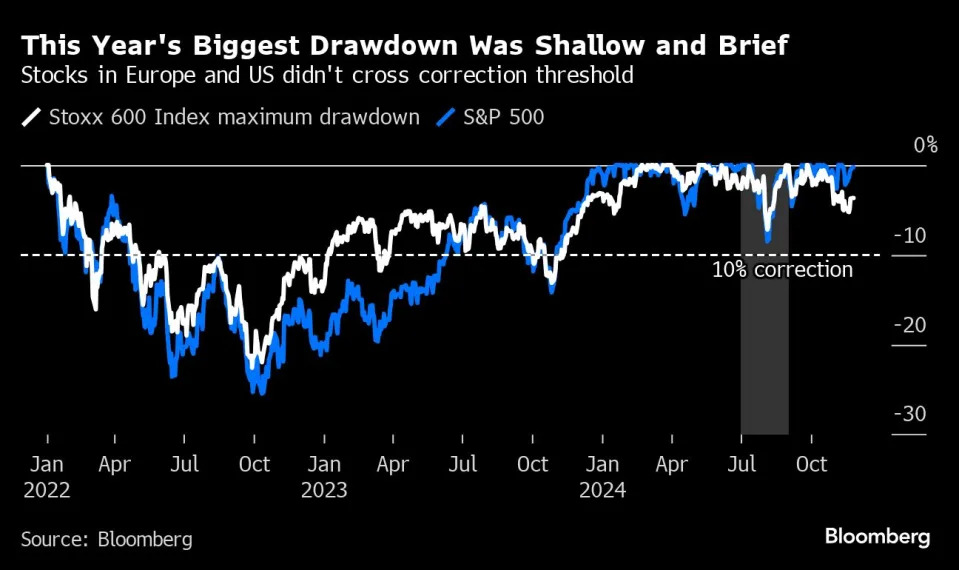

Market swings were benign with only one big valley of tears: a summer correction that culminated in a small selloff around early August. The drop lasted for just less than a month and failed to cross the threshold of 10%, typically seen as a correction.

And while geopolitics were a constant threat, not an escalating conflict in the Middle East, nor the ongoing war in Ukraine or the US presidential election provided for any deep-rooted fears. China unleashed a wave of stimulus, and though it isn’t out of the woods yet, it was enough to keep the narrative of a healthy global economy alive.

And even Europe did well. Most of the region’s country benchmarks are in the green this year despite a shaky economic outlook and collapsing governments in France and Germany. Gains in the US were so strong, however, that the Stoxx 600 ( ^STOXX ) is set for one of its worst years versus the S&P 500. French equities are also a rare developed-market underperformer in 2024 due to political turmoil.

As the new year looms, the mood this time is tilted toward the upside with nobody on Wall Street expecting a major correction, though there’s a hint of skepticism if stocks will be able to pull of three great years in a row.

“Earnings growth forecasts for 2025 in the US remain optimistic, at around 15%. This continued resilience is to some extent a little surprising, because the global economy is not without risks as we move into 2025,” Davies said.