News

Bitcoin’s rally is making some investors nervous about the stock market

Bitcoin’s run toward $100,000 has helped unleash massive gains for shares of some cryptocurrency-related companies. But it’s also raising questions about what it might mean for the rest of the stock market.

As the pioneering cryptocurrency BTCUSD nears another round-number milestone, its rally, according to some observers, is becoming yet another warning sign that markets are at risk of overheating.

The concern is that investor appetite for risk assets — a category that includes both bitcoin and stocks — is nearing frothy levels last seen back in 2021. As many might remember, that period briefly bestowed huge gains on investors. But it ultimately set the stage for a punishing bear market the following year that saddled novice investors with huge losses.

As they did then, valuations in some corners of the stock market are looking conspicuously rich. Carvana Co. CVNA is one notable example; shares of the car-focused e-commerce company have gained roughly 370% so far this year, according to FactSet data.

Even the S&P 500 SPX recently saw its valuation climb above 22 times next year’s earnings for the first time since 2021, Dow Jones Market Data showed.

“My fear is we’re going to get another round of this craziness in the market that’s not sustainable, and people are going to get hurt,” said George Cipolloni, a portfolio manager at Penn Mutual Asset Management, during an interview with MarketWatch on Friday.

While it’s hard to say whether the amount of euphoria coursing through markets has reached dangerous levels, one thing is for sure: There’s a lot more enthusiasm and frothiness in the market today than there was one month ago, Cipolloni said.

Some on Wall Street have pointed to signs that investor optimism might be verging on excessive.

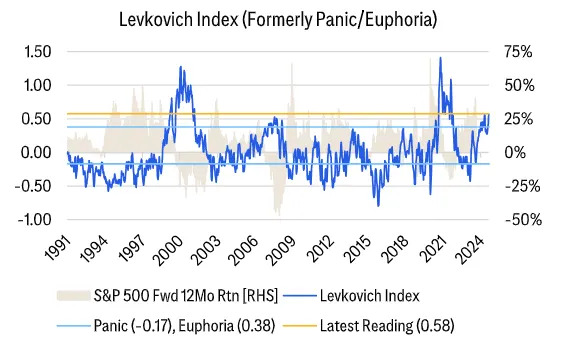

Citigroup’s Scott Chronert pointed out in a Friday report that the Levkovitch Index, the bank’s preferred gauge of sentiment in the stock market, has risen sharply over the past few weeks. Although it remains well below its highs from 2021, the index has prompted Citi to include sentiment in its list of reasons to be cautious about where the market might be headed next.

Echoes of 2021

While some of the trading action might look similar, there are many differences between 2021 and the macroeconomic backdrop of today.

Back in 2021, interest rates and bond yields were at rock-bottom levels, while the federal government was flooding the economy with stimulus money.

As of Friday, the yield on the 10-year Treasury note BX:TMUBMUSD10Y was trading at around 4.40%, compared with 1.50% in December 2021, FactSet data showed. Bond yields move inversely to prices.

If anything, higher yields today arguably raise the stakes for the market, said Mohannad Aama, portfolio manager at Beam Capital Management.

“Yields are the biggest question mark here, because we have a Fed that is easing but yields that continue to rise, which is really a conundrum,” Aama said on Friday during an interview with MarketWatch.

Instead of succumbing to the pressure imposed by higher borrowing costs, both stocks and bitcoin have been riding the enthusiasm of the “Trump trade,” Aama added.

The downside is that this has left both assets priced for perfection.

But if corporate earnings don’t meet investors’ expectations, or if President-elect Donald Trump doesn’t follow through on his promise to create a national bitcoin reserve, the two markets could be in trouble, Aama noted.

“If you look at the S&P 500 and the Nasdaq, they’re pricing in a lot of good news,” he said. “If that doesn’t materialize, it’s going to be problematic.”

U.S. stocks finished higher on Friday , with the S&P 500, Nasdaq Composite COMP and Dow Jones Industrial Average DJIA all tallying weekly gains — and the Dow notching a fresh record close.