News

Buy These 5 Crypto-Centric Stocks as Bitcoin Crosses a Key Landmark

On Dec. 4, Bitcoin (BTC), the largest cryptocurrency globally, recorded an all-time high of $103,844.05, before closing at $103,544. For the first time, Bitcoin crossed the crucial $1,00,000 mark. Year to date, Bitcoin has soared more than 140%.

Bitcoin’s northbound journey will continue in the near term following President-elect Donald Trump’s crypto-friendly policies and a low-interest rate regime adopted by the Fed. At this stage, we recommend five crypto-centric stocks for investment purpose. These are NVIDIA Corp. NVDA, Coinbase Global Inc. COIN, BlackRock Inc. BLK, Hut 8 Corp. HUT and Robinhood Markets Inc. HOOD.

Crypto Space Will Continue to Flourish

Bitcoin has jumped nearly 50% since Donlad Trump became the President-elect on Nov 5. Trump committed several crypto-friendly policies in his election rallies.

On Dec. 4, Donald Trump posted on social media that he plans to nominate former SEC Commissioner Paul Atkins to head the agency again. Atkins will succeed the incumbent Commissioner Gary Gensler, widely known for his strong negative view regarding the digital currency space.

During his election speech, Donald Trump said he will enact a strategic national crypto stockpile ensuring that the federal government never sells off its Bitcoin holdings. In June, Trump posted on social media, “If crypto is going to define the future, I want it to be mined, minted and made in the USA.”

Trump posted “Biden’s hatred of Bitcoin only helps China, Russia, and the Radical Communist Left. We want all the remaining Bitcoin to be MADE IN THE USA!!! It will help us be ENERGY DOMINANT!!!”

Low Interest Rate Regime

A low interest rate is beneficial for high growth-oriented industries such as technology, consumer discretionary and cryptocurrency. The Fed reduced the benchmark lending rate by 75 basis points to 4.50-4.75% in two consecutive FOMC meetings in September and November.

The CME FedWatch interest rate derivative tool currently shows a 77.5% probability that the central bank will cut the Fed fund rate by another 25 basis points in the December FOMC meeting. If this materializes, then the central bank will cut the Fed fund rate by a full 1% in this year.

5 Bitcoin-Centric Stocks to Buy

These five stocks have strong potential for the near term. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

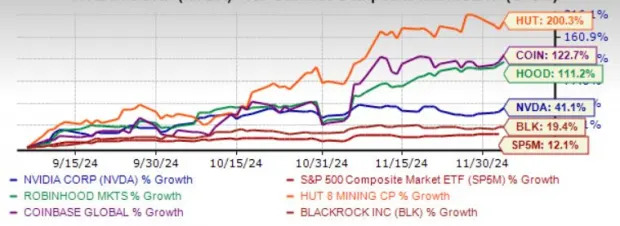

The chart below shows the price performance of our five picks in the past three months.

NVIDIA Corp.

NVIDIA is a semiconductor industry giant and one of the biggest success stories of 2023 and 2024. As a leading designer of graphic processing units (GPUs), NVDA stock usually soars on a booming crypto market. This is because GPUs are pivotal to data centers, artificial intelligence, and the creation of crypto assets.

NVIDIA has an expected revenue and earnings growth rate of more than 100% each for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 3.9% over the past 30 days.

Coinbase Global Inc.

Coinbase Global provides financial infrastructure and technology for the crypto economy in the United States and internationally. COIN offers the primary financial account in the crypto space for consumers, a marketplace with a pool of liquidity for transacting in crypto assets for institutions, and technology and services that enable developers to build crypto-based applications and securely accept crypto assets as payment.

Coinbase Global has an expected revenue and earnings growth rate of 80.6% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.3% over the past 30 days.

BlackRock Inc.

BlackRock is one of the world’s largest publicly owned investment managers. BLK was one of the first companies from the traditional market to join the Bitcoin ETF race in June 2023. BlackRock’s iShares Bitcoin Trust has crossed $10 billion in assets under management in less than two months. Currently BLK’s Bitcoin Trust has more than $34 billion in assets under management.

BlackRock has an expected revenue and earnings growth rate of 13.8% and 14.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the past seven days.

Hut 8 Corp.

Hut 8 acquires, builds, manages, and operates data centers for digital assets mining, computing, and artificial intelligence in the United States. HUT mines Bitcoin. It merged with US Bitcoin Corp. to increase its total hash rate substantially. HUT aims to increase its total hash rate to 9.8 EH/s. HUT operates in four segments: Digital Assets Mining, Managed Services, High Performance Computing, Colocation and Cloud, and Other.

Hut 8 has an expected revenue and earnings growth rate of 41.9% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 17.2% over the past 30 days.

Robinhood Markets Inc.

Robinhood Markets operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies using its Robinhood Crypto platform.

Robinhood Markets has an expected revenue and earnings growth rate of 41.6% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.2% over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Hut 8 Corp. (HUT) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research