News

This analyst talked of $100,000 bitcoin a decade ago — here’s what he says now

Well, bitcoin has finally crossed $100,000, not bad for an asset whose underlying value is no different to imaginary rainbow unicorns. Granted, that unicorn has fans at the highest levels of officialdom, and even Federal Reserve Chair Jerome Powell seemed to bless it on Wednesday: “It’s just like gold only it’s digital, it’s virtual,” he said at the DealBook conference.

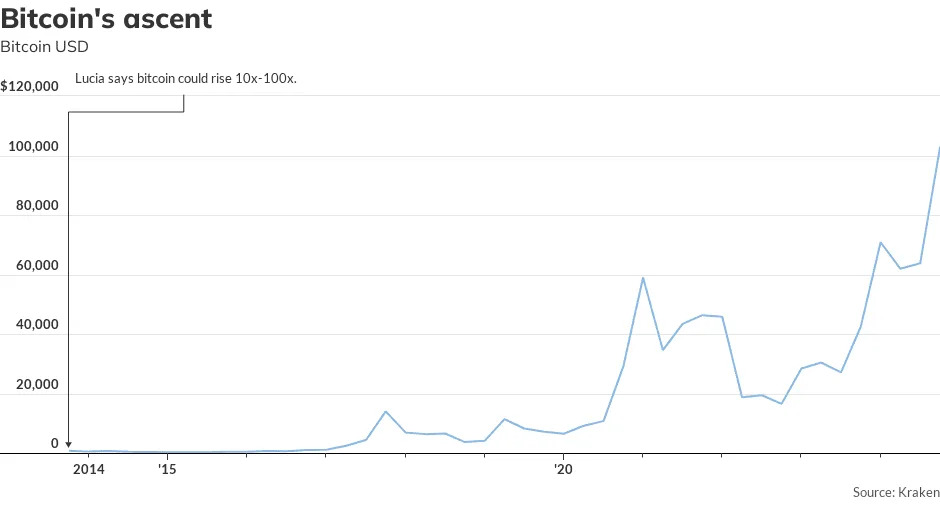

D.A. Davidson’s Gil Luria authored what is believed to be the first sell-side report on bitcoin — back in December 2013, when he was at Wedbush — and as far as calls go, it was pretty good. When bitcoin BTCUSD was trading around $1,000, he said “scenarios exist by which a bitcoin can be worth 10-100x its current price.”

Well, here we are, at the outer limits of his imagination then. So what is he saying now? “The bitcoin network has worked without fail since January 3, 2009 and has moved $trillions of value since. It has survived countless innovative competitors, including from the largest corporate entities, and has remained the most valuable crypto asset,” he says in a new report.

How does he value it? He says the key is the small probability that bitcoin becomes all of money — not supplementing the dollar and other fiat currencies, as Powell believes, but replacing it entirely.

“We would ascribe a 1-2% chance to that outcome, which would be enough to explain the current asset price. Since the global money supply is in the magnitude of $100 trillion, bitcoin becoming [All of] Money would imply a value closer to $5 million per bitcoin. If one believes that there is a 1-2% chance for this outcome, and that there are other valuable use cases for the bitcoin network otherwise, the current $100,000 price would reflect that,” says Luria along with colleague Alexander Platt.

Luria said he would have assigned a 0% probability to that outcome 10 years ago, and maybe 0.1% five years ago, but “as the bitcoin network endures, adoption rises, and the bitcoin asset expands, we believe this outcome has a chance of becoming a self-fulfilling prophecy.”

More like Powell — and some other analysts, like BCA’s Dhaval Joshi — Luria says bitcoin’s main primary application is as a store of value, “an appreciating, low-correlation asset that replaces gold as a hedge against a decline in economic stability.”

But wait, isn’t bitcoin extremely correlated to the stock market, and in particular, a product like the ProShares UltraPro QQQ TQQQ? “While many would point to periods of high correlation to other risk assets and the lack of correlation to a rise in inflation, we would recommend zooming out. In the pre-hyper-liquidity era and recently [in the post-hyper-liquidity-era], we believe the correlation is appropriately lower. While these asset prices may be linked by liquidity, the fundamentals of bitcoin are mostly driven by adoption, which is much more loosely linked to the drivers of stocks, bonds, and real estate (e.g. employment, productivity, monetary policy, regulation, tax policy, inflation, globalization, etc.),” says Luria.

He does say that as a medium of exchange and unit of account, bitcoin not only has competition from fiat currencies but also stablecoins — which could become the medium of exchange, cementing the dollar as the dominant global unit of account.

He says bitcoin’s second most important application is trading. “With the deepest liquidity, global decentralized venues, 24/7 trading, digital nature, and near constant news flows, bitcoin is the perfect trading asset. Humans will bet on anything—stocks, sports, animal racing, card games, elections, etc.—and bitcoin has all the best features of these bets, including a long line of testimonials from people that have made fortunes investing and trading bitcoin,” says Luria. There really is nothing like number go up.

The market

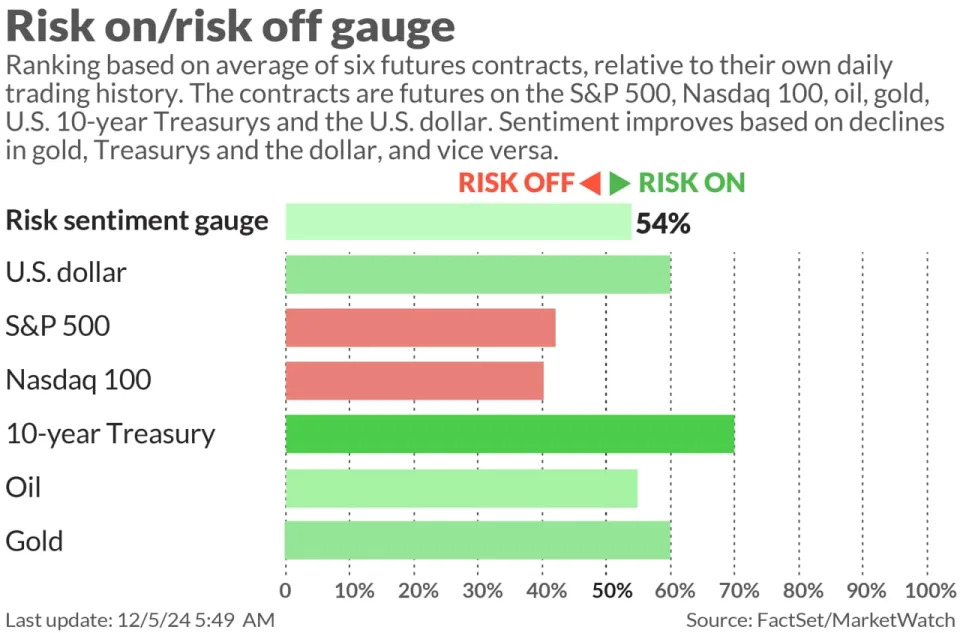

U.S. stock index futures ES00 NQ00 were hovering near record levels early Thursday, following the 56th record high reached on the S&P 500 SPX this year. Bond yields BX:TMUBMUSD10Yedged higher.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

6086.49 |

1.46% |

1.90% |

27.60% |

32.73% |

|

Nasdaq Composite |

19,735.12 |

3.54% |

3.96% |

31.47% |

39.50% |

|

10-year Treasury |

4.202 |

-6.20 |

-14.00 |

32.11 |

4.59 |

|

Gold |

2671.9 |

1.35% |

-1.55% |

28.97% |

30.64% |

|

Oil |

68.87 |

0.15% |

-4.60% |

-3.45% |

-1.11% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

Jobless claims rose more than expected, rising by 9,000 to 224,000, while the trade deficit fell 12% to $73.8 billion in October.

Dollar General DG, after well-received Dollar Tree DLTR results, lowered the top end of its earnings outlook while it said same-store sales were near the top end of its expectations given a “financial constrained” core consumer.

Five Below FIVE late Wednesday raised its full-year outlook after an encouraging Black Friday performance as it also named a new chief executive.

American Eagle Outfitters AEO missed on third-quarter sales expectations and forecast a decline in fourth-quarter sales .

Old Dominion Freight Line ODFL, which transports goods in quantities that don’t require a full truck, reported an 8.2% decline in revenue per day in November, blaming in part the “continued softness in the domestic economy.”

Synopsys SNPS, a provider of electronic design automation software, guided for revenue growth below expectations.

Best of the web

Bullet casings found at scene of UnitedHealthcare exec shooting had the words ‘deny,’ ‘defend’ and ‘depose’ on them.

A triumph of mediocrity: the dirty secret of executive compensation.

Wealthy Americans are paying for their own fire hydrants.

The chart

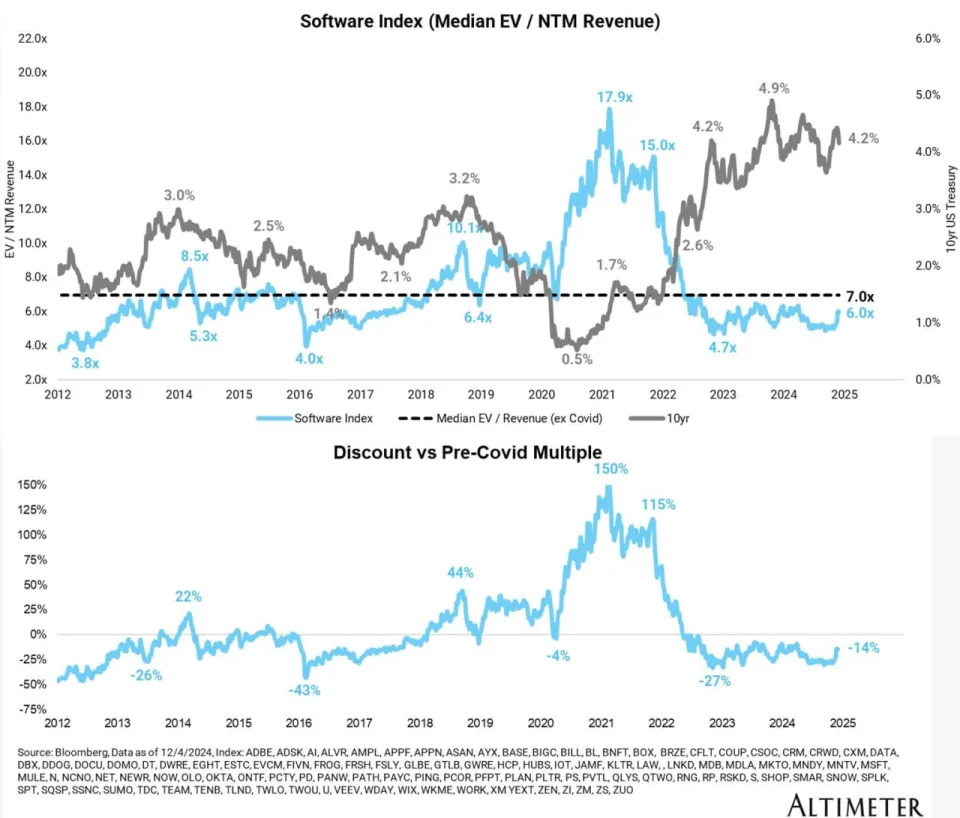

Altimeter Capital founder Brad Gerstner pounded the table for software stocks back in June, arguing the sector was trading 15% below its 10-year average. The call was prescient: the iShares Expanded Tech-Software ETF IGV has jumped 42% from its August lows. He shared this chart showing software multiples are still below their average and trading at a discount to pre-COVID multiples.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

MSTR |

MicroStrategy |

|

GME |

GameStop |

|

PLTR |

Palantir Technologies |

|

SMCI |

Super Micro Computer |

|

MARA |

Mara Holdings |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

DJT |

Trump Media & Technology |

|

AMZN |

Amazon.com |

Random reads

Thailand’s starring role in ‘The White Lotus’ is about to pay off.

Mysterious drones are buzzing over central New Jersey.

This cow — “with the mentality of a horse and the personality of a dog” — frequents the drive-thru at Tim Hortons.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .