News

Billionaires have been beating the stock market — where they are putting their money now, according to UBS

While global stock markets have been on a pretty good run over the past decade, the billionaires have apparently got them beat.

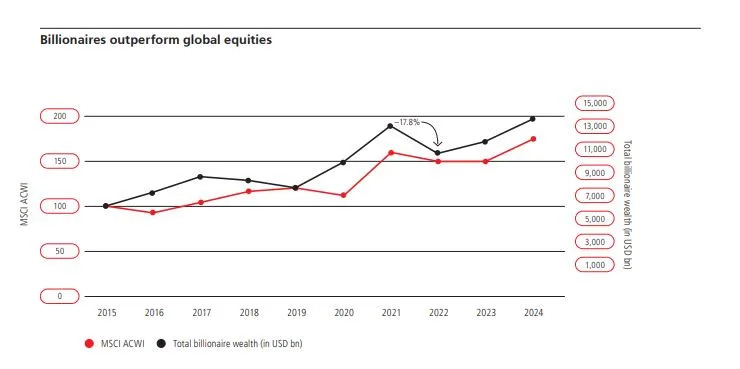

That’s according to the 10th annual “Billionaire Ambitions Report” for 2024, recently published by UBS. At the top of that report was data showing that between 2015 and 2024, total billionaire wealth rose by 121% globally, from $6.3 trillion to $14 trillion. The bank compared that to the MSCI AC World Index, which posted a 73% gain in the same time frame. The S&P 500 SPX, incidentally, has gained about 77% in the same period.

Here’s their chart:

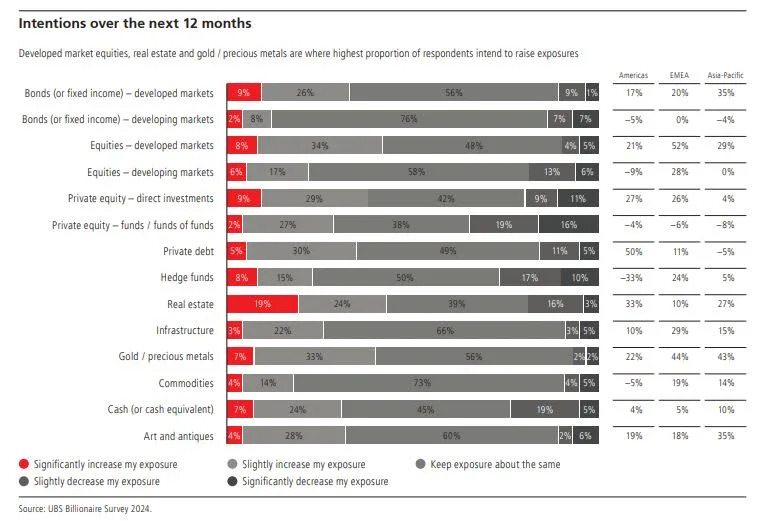

As for how those billionaires plan to hang onto that wealth, the UBS research finds those asset-class views shifting as U.S. and eurozone central banks lower interest rates.

Over the next year, 43% of billionaires said they would boost exposure to real estate and 42% to developed market equities. But they’re also looking to increase investments in “perceived havens from market storms,” with 40% signaling intentions to boost gold and precious metals exposure, and 31% cash levels.

Wealthy individuals remain keen on alternative investments, with 38% planning to boost direct private equity holdings, though 28% plan to raise private-equity funds/funds of funds holdings and 34% want to decrease them. Some 26% plan to boost infrastructure investments, and 35% private debt. But 27% of billionaires surveyed citing plans to decrease hedge-fund investments against 23% wanting to increase that segment.

Also nearly a third, or 32%, want to invest more in art and antiques, a notable boost from 11% last year.

Many billionaires see the best opportunities in North America, with 80% preferring that region over the next 12 months, and 68% over the next five years, as they cite technological innovations as well as energy security amid global instability. Just 11% see more opportunity in China.

North American billionaire wealth, incidentally jumped 52.7% to $3.8 trillion between 2015 and 2020, and another 58.5% between 2020 and 2024, led by industrials and tech billionaires, to $6.1 trillion, UBS said. The region also hosts the greatest percentage of the top 100 billionaires — 43%, versus 21% in Western Europe, 15% in Southeast Asia and 8% in China.

Tech billionaires wealth across the globe, not surprisingly, saw their wealth grow the fastest of any sector, from $788.9 billion in 2015 to $2.4 trillion in 2024, UBS said.

The overall number of billionaires grew from 1,757 to 2,682 between 2015 and 2024, with the peak hit in 2021 with 2,686 billionaires, but since that time growth has remained flat.

Finally, UBS notes that over 10 years, multigenerational billionaires have inherited a total of $1.3 trillion. “Naturally, this amount understates the total inheritance as many heirs have not themselves become billionaires,” they said.

“Looking forward, we calculate that billionaires aged 70 or more will transfer $6.3 trillion over the next 15 years, mainly to families but also chosen causes,” and that’s well over 2023’s estimate of $5.2 trillion over 20 – 30 years, due to asset price inflation and billionaires aging, the report said.