News

US light vehicle market enjoying strong moment despite uncertainty

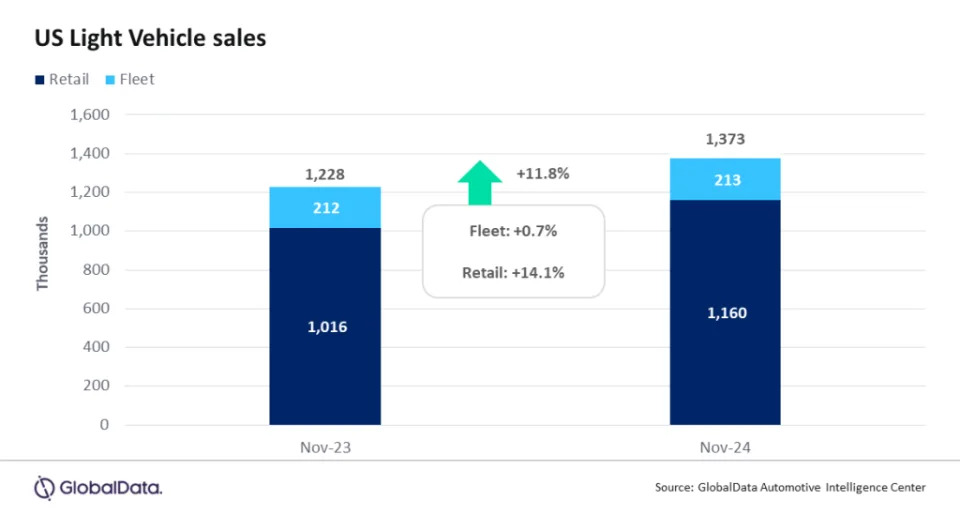

According to preliminary estimates, Light Vehicle (LV) sales grew by 11.8% year-on-year (YoY) in November, to 1.37 mn units. The month had one additional selling day compared to November 2023, which was also impacted by strike action. Nonetheless, last month’s performance was still impressive and surpassed expectations.

US LV sales totaled 1.37 mn units in November, according to GlobalData. The annualized selling rate for the month was 16.7 mn units/year, up from 16.3 mn units/year in October, and the strongest since May 2021. The daily selling rate was estimated at 52.8k units/day in November, up from 49.9k units/day in October. With October marking an upbeat start to Q4, the momentum continued into November, as higher levels of inventory, increasing incentives, and the return of some models after the lifting of stop-sale orders drove gains. According to initial estimates, retail sales totaled 1.16 mn units in November, while fleet sales finished at 213k units, accounting for 15.5% of total volumes.

General Motors (GM) once again topped the sales rankings in November. The OEM achieved its highest volumes (244k units) since December 2020 and its largest market share (17.8%) since January 2021. Toyota Group experienced a better month than has been the case recently, recording only its second month of YoY growth in the past six months with volumes of 207k units in November. Toyota Group’s struggles have been closely linked with the stop-sale orders on the Toyota Grand Highlander and Lexus TX, but with those models now available once again, sales rebounded in November. The Grand Highlander recorded sales of 7.2k units last month, close to its typical monthly volumes. Ford Group was the third-largest OEM by sales, on 161k units. At a brand level, Toyota pulled clear of its nearest challengers, reaching 173k units. In the battle for second place, Chevrolet (157k units) beat Ford (151k units) for the first time since August 2023.

The Toyota RAV4 was the bestselling model in November on 41.2k units, leading the Ford F-150, which recorded sales of 38.9k units. The Tesla Model Y appears to have had an unusually weak month with 26.4k units sold, placing it well outside the top five models. In contrast, the Chevrolet Equinox surged in November with 29.4k units, its highest volume since December 2020.

Compact Non-Premium SUVs saw another robust month with a market share of 21.3%, thanks to strong contributions from the likes of the Toyota RAV4, the Chevrolet Equinox and the Honda CR-V. Midsize Non-Premium SUVs logged a somewhat more encouraging month than recent performances, with a market share of 15.0%. The Chevrolet Traverse’s market share was its highest since its redesign earlier in 2024. Meanwhile, Large Pickups recorded a market share of 14.1%, with the segment’s performance having plateaued in recent months.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “Despite some uncertainty over the longer-term outlook for the industry amid potential changes in policy, November sales delivered a strong performance. Volumes were reminiscent of pre-pandemic times, after several years in which the market has been subdued. Even though headlines around Electric Vehicles (EVs) have generally been focused on the negatives, brands with a range of electrified offerings, including hybrids, tended to see an enthusiastic response in November. However, some consumers could now be moving to take advantage of EV tax credits, given that the incoming Trump administration has signaled that these credits could be scaled back or removed entirely. Credit availability appears to be improving as interest rates on auto loans slowly creep down, but some of that positivity is being tempered by lower trade-in equity for consumers.”

Days' supply is expected to decrease to the 55-57 day range in November as production levels moderate and the daily selling rate improves. US inventory levels are projected to have ended November at 2.9 mn units, approximately 1% lower (-30k units) than in October. North American production volumes for 2024 are holding steady at 15.5 mn units, representing a 1% decline from 2023. Pickup Truck inventory continues to be a concern, potentially leading to year-end deals for consumers or a production slowdown in early 2025 to address high inventory levels.

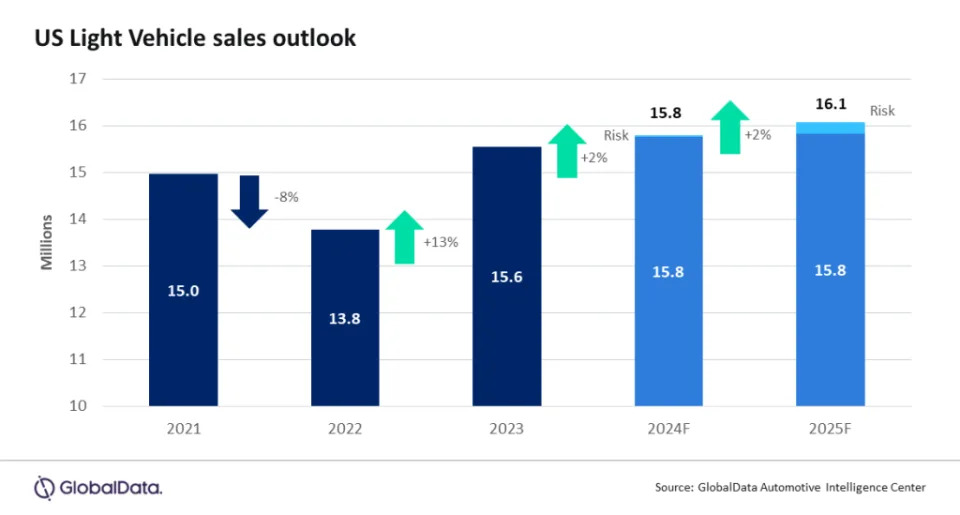

Strong demand in November all but solidified the 2024 forecast at 15.8 mn units, which is an increase of just 1.6% from 2023. Fleet sales remain well below the historic share of total volumes and are projected to finish the year down by 1.6% (-50k units) from 2023, representing 17.8% of total LV sales. Lower fleet share is expected to spill into 2025. Given the weaker fleet volume and general heightened level of uncertainty, the 2025 forecast has been cut by 200k units to 16.1 mn units, representing an increase of 1.8% from 2024.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “As we look ahead to 2025, all attention will be on the initial policy decisions from the Trump administration in January. The potential imposition of tariffs on virtually all vehicles manufactured outside the US could have a notably adverse effect on pricing, leading to reduced volumes both at the overall level and for individual brands with import exposure. Approximately 45% of all vehicles sold in the US are imported, with 23% of sales originating from Canada and Mexico. If a 25% tariff were implemented on imported vehicles, US sales could decline by over 1 mn units annually. Given the risks to the automotive sector and the economy, we view this as a negotiating strategy that may not fully materialize. Nonetheless, the prevailing uncertainty is presenting significant challenges to the industry.”

Global outlook: The global LV sales rate surged in October to 93 mn units, the highest since August 2023. Volumes increased by 6.4% YoY, breaking the four-month streak of decline. Year-to-date (YTD) volumes have also improved to 1.0% higher than in 2023, with October outperforming expectations. Globally, sales experienced a resurgence across most markets. Outperformers in October included Russia (+51%), North America (+12%), and Brazil (+21%). Sales in China were also up by 6%, but that was pulled down by Light Commercial Vehicles (LCVs), which dropped by 27%. Western Europe was the drag for the month, with a decline of 0.7% from a year ago. Following a strong October, the 2024 forecast now stands at 88.4 mn units/year, up by 300k units from last month, with growth from 2023 now projected at 1.8% YoY.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

"US light vehicle market enjoying strong moment despite uncertainty" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.