News

Wall Street isn’t worried about a stock-market crash. That’s why you should be.

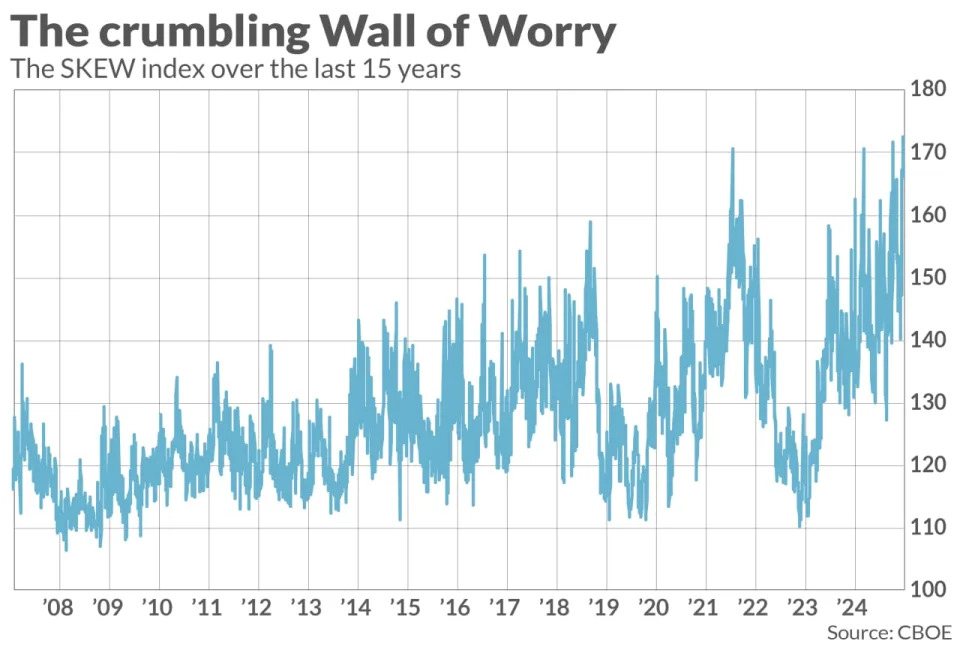

Yet another black cloud on the stock market’s horizon is the new all-time high for the CBOE’s SKEW Index .

Most market commentators are putting a different spin on this index’s new high . They suggest that traders now believe a Black Swan event, such as a crash, has become more likely. But if that were so, it would be a positive development to contrarian investors, indicating that Wall Street is not as irrationally exuberant as other sentiment indices are suggesting .

The SKEW’s new high actually means just the opposite. It means that the great majority of traders have become even more bullish than they were before. And that’s bearish from a contrarian point of view.

To understand, it’s helpful to review how the SKEW is calculated. Though the mathematics involved in its calculation are complex, it in effect measures the divergence between (a) the consensus expectation of the majority of traders, and (b) the view of a super-bearish minority. The SKEW index grows when the spread widens between these two groups’ beliefs about the market.

There are two ways in which that spread can widen. One is for that super-bearish minority to become even more bearish, while the consensus view of the majority of traders remains more or less the same. This is what commentators presume has happened when they interpret the high SKEW reading to mean that some traders have become more worried about a crash.

The other, less appreciated way for the SKEW to rise is for the super-bearish minority to remain just as bearish, while everyone else becomes even more bullish. In that case, instead of a higher SKEW indicating that the bearish minority has become more worried about a crash, it means that the consensus among the majority of traders has become less worried.

Needless to say, the investment implications of these two possibilities are vastly different.

The real reason for the SKEW’s rise

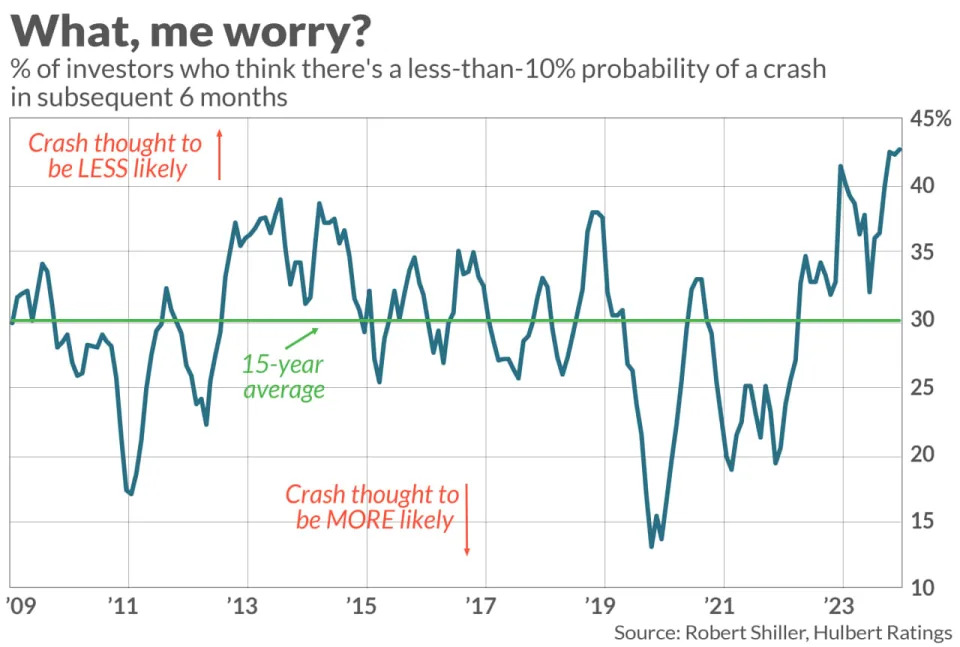

There are two reasons why we can be confident that the SKEW’s all-time high means that traders have become less worried about a Black Swan event — rather than more worried. The first is a monthly survey conducted by Yale University’s Robert Shiller, called the “U.S. Crash Confidence Index.” As you can see from the chart below, individual investors are now less worried about a possible crash than at any time in the past 15 years. It would be odd, to say the least, if Shiller’s data indicated near-record low concern about a crash while the CBOE data indicated just the opposite.

The second reason why the SKEW’s new high reflects less rather than more concern about a market crash is that the index in the past has consistently risen in synch with bull markets. That’s because the Wall Street consensus becomes more bullish as the market rises, thereby widening the spread between the consensus expectation and that of the super-bearish minority.

This close relationship between bull markets and a rising SKEW index is evident from the correlation between the two over the past 15 years. The correlation coefficient is 56.3% between the S&P 500’s SPX trailing 12-month return and that of the SKEW index, which is highly significant from a statistical point of view.

The bottom line? Despite claims to the contrary, Wall Street isn’t worried about a market crash. That’s why we should be worried.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Yes, stocks are pricey and too popular — but overbought does not mean ‘sell’

Plus: Stock buybacks soar as holiday rally breaks records