News

Finally, there’s a strategist who expects the stock market to fall next year — here’s why

Scientists have shot down that whole put-enough-monkeys-in-front-of-a-typewriter-and-they-will-eventually-produce-Shakespeare theory, but a corollary is that if you gather enough strategists on Wall Street then one of them is bound to predict that the stock market will fall.

Finally, that call is here, courtesy of Stifel’s Barry Bannister, and he doesn’t monkey around in forecasting that the S&P 500 index SPX will correct all the way down to the middle-5,000s in the second half of 2025.

That’s hardly outrageous — at 5,500, that would represent a 10% decline from current levels, but all the other Wall Street targets for next year are in the 6,000s and higher.

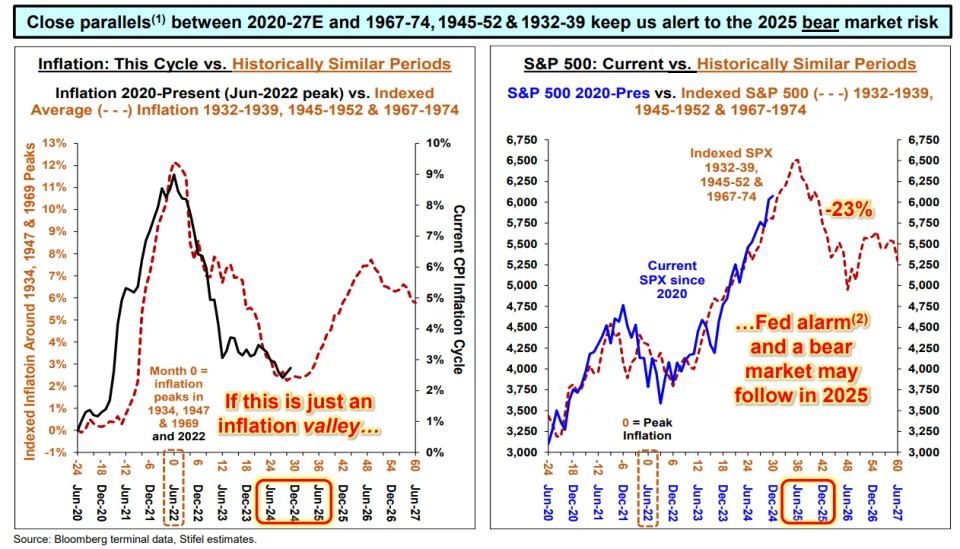

Bannister’s view is that the Federal Reserve only has two more interest-rate cuts left — one next week and another in January — with sticky inflation and zero visibility on fiscal policy. Borrowing a popular technical-analysis trick, he says the old inflation ceiling (as measured by the core PCE price index) is turning into the new floor, leaving it closer to 3% than the Fed’s goal of 2%.

And this forecast lack of Fed action comes against the backdrop of ebullient markets. Bannister says the S&P 500 and growth vs. value are both at three-generation highs and euphoric levels.

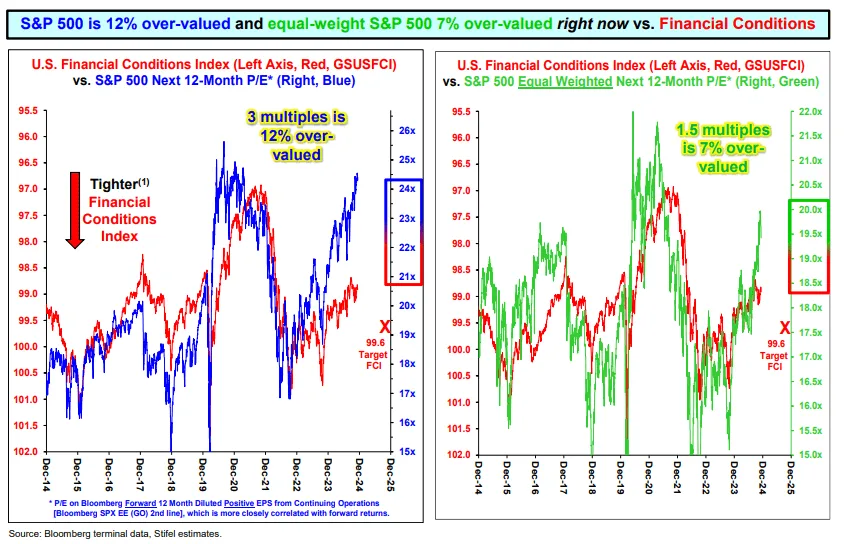

He does an interesting calculation, measuring a financial-conditions index against S&P 500 price-to-earnings as well as the equal-weight version of that index.

Taking the 10-year average of inflation-adjusted S&P 500 operating earnings per share divided by the price, and it hasn’t ever breached the 3% level it’s at now, he says.

But valuations alone won’t cause the market disruption; he says the trigger will be a slowdown in the economy during the second half of the year.

And the close parallels between the current inflation cycle and those of 1967–74, 1945–52 and 1932–39 keeps him alert to a bear-market risk. That pessimism has him arguing for defensive value stocks: utilities, pharma, biotech, healthcare, household products, professional services and retail staples. He lists 50 of them, including Costco COST, Philip Morris International PM and Abbott Laboratories ABT, that also have buy ratings from the firm’s analysts.

Bannister also makes an interesting digital-asset comment with bitcoin prices BTCUSD back over $100,000 — he says bitcoin is not digital gold but cyclical growth. Gold GC00, on the other hand, is defensive value. He says bitcoin is reliant on Fed dovishness because it is a low-inflation-with-solid-economic-growth asset.

The market

Stock-index futures ES00 NQ00 were leaning lower early Thursday as bond yields BX:TMUBMUSD10Y rose on worries over the Fed’s fight against inflation in the last mile.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

6084.19 |

-0.04% |

1.65% |

27.56% |

29.26% |

|

Nasdaq Composite |

20,034.89 |

1.52% |

4.18% |

33.46% |

35.98% |

|

10-year Treasury |

4.301 |

13.10 |

-14.30 |

42.01 |

38.72 |

|

Gold |

2749.3 |

3.55% |

6.96% |

32.70% |

34.03% |

|

Oil |

70.34 |

2.76% |

2.51% |

-1.39% |

-1.83% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

Producer prices for November were hotter than expected , rising 0.4%, as initial jobless claims rose by 17,000 to 242,000 .

The Swiss National Bank followed the Bank of Canada in making a half-percentage-point rate cut as the European Central Bank cut rates by a quarter-point.

Also see: Are negative interest rates about to make a comeback? One banker says it’s possible

CBS reported that President-elect Donald Trump, who is ringing the opening bell on the New York Stock Exchange , has invited Chinese President Xi Jinping to his inauguration — a move that suggests import tariffs on goods incoming from China may be implemented later rather than sooner.

Adobe ADBE late Wednesday forecast weaker sales than Wall Street had estimated for the current year.

The Biden administration is overhauling rules for how banks can charge overdraft fees to customers.

After the close, Broadcom AVGO and Costco release results.

Best of the web

Quantum computing stocks are soaring as investors place bets on the next big thing in tech.

Elon Musk’s wealth just cro s sed $400 billion — and now he can say he’s Rockefeller rich

How 3 sommeliers risked millions to buy, and sell, a once-in-a-lifetime wine collection.

The chart

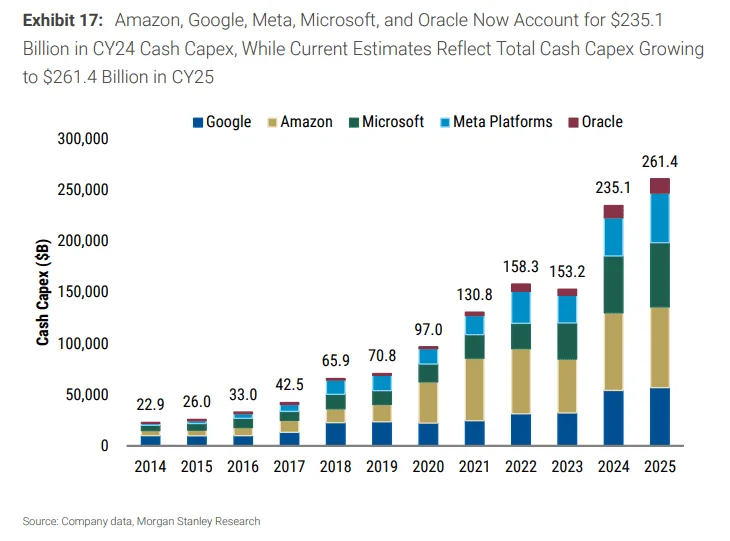

Morgan Stanley has a note on the key investor debates likely to drive stocks in the coming year, and one of those arguments is on the willingness of so-called hyperscalers to spend. This chart shows the surge in capital spending from tech giants including Amazon, Microsoft and Google. Will it continue? The bank’s analysts are unsure about the capacity of AI models to process large amounts of new data quickly and accurately. “To weigh in on whether the compute scaling paradigm has indeed hit a wall, we believe it is too early to make a call without seeing the new data points first, for example through the results of next-generation models such as xAI’s Grok-3, Meta’s Llama 4, or OpenAI’s GPT-5 or the development brought upon on clusters such as AWS’ Project Rainier (up to 20.8 FP8 petaflops),” they say.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

GME |

GameStop |

|

NVDA |

Nvidia |

|

PLTR |

Palantir Technologies |

|

MSTR |

MicroStrategy |

|

SMCI |

Super Micro Computer |

|

AAPL |

Apple |

|

AMZN |

Amazon.com |

|

AMD |

Advanced Micro Devices |

|

TSM |

Taiwan Semiconductor Manufacturing |

Random reads

RIP to the Amazing Kreskin.

A U.K. spy agency has sent out its annual Christmas card — which are difficult puzzles to help identify future codebreakers.

The Tiger Woods of Spanish Scrabble doesn’t speak the language .