News

This could be the ‘next big thing’ for the stock market after generative AI

Investors and traders in the stock market love to ride momentum, and the build-out of data processing infrastructure to support generative artificial intelligence seems likely to continue for some time.

The consensus among analysts polled by FactSet is for the AI-hardware leader Nvidia Corp. NVDA to increase its revenue by 55% in calendar 2025 to $191.45 billion. That would be a cool-down from the expected increase of 122% for calendar 2024 and the doubling of Nvidia’s sales in calendar 2023.

So what might be the next tech-oriented momentum play for speculative investors? Joseph Adinolfi looked into the flurry of recent interest in companies developing quantum computing technology . This week’s action for quantum-oriented stocks has been driven by Google’s announcement of vast improvements in computer processing speeds and accuracy improvements for its Willow quantum chip .

Software stock and artificial intelligence

For generative AI, concentrated coverage of the hardware build-out is understandable in light of Nvidia’s revenue growth as it has dominated the market for graphics processing units that support the new technology. But what about the practical application of AI? Emily Bary explained how AI software stocks compare with AI hardware stocks .

Related stock screens:

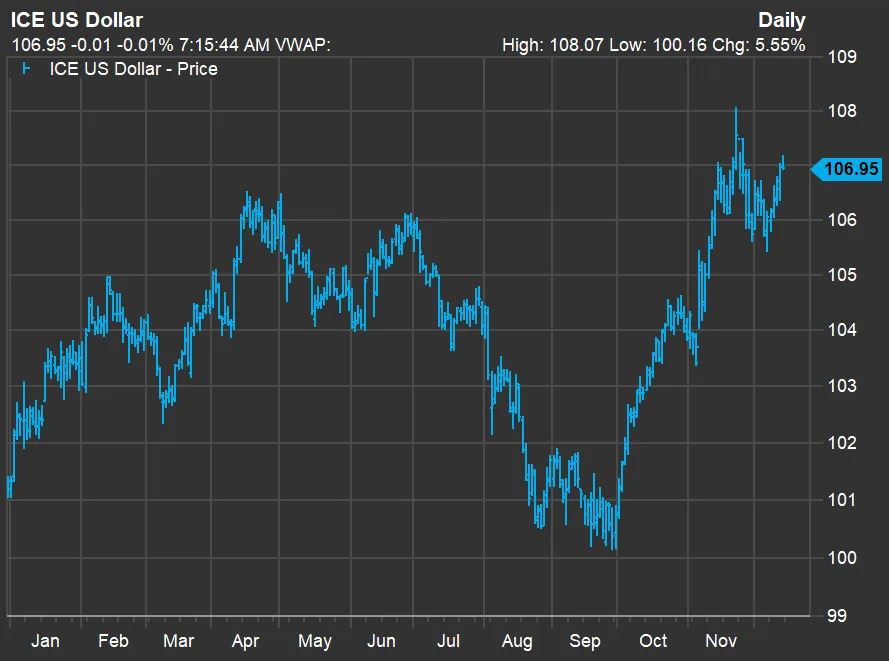

A contrarian opinion about the dollar

The chart above shows this year’s movement for the U.S. Dollar Index DXY. The dollar is below its peak valuation for 2024, and it traded as high as 112.6 (as measured by the index against a basket of six other developed-market currencies) as recently as October 2022. But it is time for traders to lower their exposure to the dollar for this reason , according to analysts at Morgan Stanley.

Related coverage of commodities markets:

Stock-market warnings and opportunities

The S&P 500 SPX has been holding up nicely. Through Thursday, the U.S. large-cap benchmark index was up 28.5% for 2024 with dividends reinvested. That is slightly better than it looked at the end of November. But since the end of last month, prices have declined for 76% of stocks in the S&P 500. Here’s why that action is a warning for investors .

The broad market’s staying power this month has reflected the dominance of a handful of companies. You are probably aware that the S&P 500 is weighted by market capitalization. After two years of rallies for Big Tech, three stocks make up a combined 20.4% of the portfolio of the SPDR S&P 500 ETF Trust SPY. These are Nvidia, which makes up 7.3% of the fund, followed by Apple Inc. AAPL at 6.6% and Microsoft Corp. MSFT at 6.5%.

Here is a mix of observations and opinions about the stock market:

Signs of revival — commercial real estate beckons

Joy Wiltermuth shares some good news for the commercial real-estate sector of the U.S. economy and an entry point for investors in 2025 .

What lies ahead for a non-tech sector that has soared this year

Here are total returns for the 11 sectors of the S&P 500, with dividends reinvested, through Thursday:

|

Sector or index |

2024 return |

2023 return |

2022 return |

Return since end of 2021 |

|

Communication Services |

46.1% |

55.8% |

-39.9% |

36.8% |

|

Information Technology |

38.6% |

57.8% |

-28.2% |

57.1% |

|

Consumer Discretionary |

35.9% |

42.4% |

-37.0% |

21.9% |

|

Financials |

33.5% |

12.1% |

-10.5% |

33.9% |

|

Utilities |

25.5% |

-7.1% |

1.6% |

18.4% |

|

Industrials |

22.2% |

18.1% |

-5.5% |

36.5% |

|

Consumer Staples |

19.5% |

0.5% |

-0.6% |

19.4% |

|

Real Estate |

10.1% |

12.4% |

-26.1% |

-8.6% |

|

Energy |

16.2% |

-1.3% |

65.7% |

79.7% |

|

Materials |

7.9% |

12.5% |

-12.3% |

5.0% |

|

Healthcare |

5.3% |

2.1% |

-2.0% |

4.7% |

|

S&P 500 |

28.5% |

26.3% |

-18.1% |

32.9% |

Returns for the sectors and the full index are shown going back to the end of 2021, to incorporate the broad declines in 2022 and the resumption of the bull market in 2023. The table is sorted by 2024 returns, but you can see that the energy sector has been the strongest performer since the end of 2021. So far this year the communications sector has been the strongest performer; this sector includes some Big Tech names, including Meta Platforms Inc. META, Alphabet Inc. GOOGL and Netflix Inc. NFLX.

The financial services sector has returned 33.5% this year. In this week’s ETF Wrap , Isabel Wang looks into whether or not investors can expect another good year for financials in 2025 .

Retirees share their Social Security timing stories

Take a look at your annual Social Security statement. You can begin collecting payments at age 62, but the monthly payments increase every year that you wait until age 70. You will see that the payments increase between 7% and 9% for every year you wait. You may find that if you wait until you are 70, your monthly payment will be 80% higher than it will be if you begin collecting at 62.

Jessica Hall spoke to several retirees about how their timing for Social Security worked out , and retirement planning experts listed factors you need to consider when making your own decision.

Beth Pinsker also has important advice for people deciding on Social Security timing. This is why signing up for Medicare and claiming Social Security benefits need to be two separate decisions .

A nest egg decision: ‘My strategy may be flawed’: Will I lose out on $500,000 SIPC insurance coverage if I only have one investment account?

Help me retire: ‘I’m nervous about the market’: We’re living off my pension as practice for retirement, but I’m afraid of a market correction

Tossing an assumption: 100% stocks for retirement? A new study says dump the 60/40 portfolio and target-date funds.

How about another Bitcoin milestone?

With bitcoin BTCUSD now above $100,000 historical trading patterns suggest it might hit $150,000 relatively soon according to one Martin Leinweber, director of digital-asset research and strategy at MarketVector Indexes. This week’s Distributed Ledger newsletter features Frances Yue’s interview with Leinweber and broader coverage of cryptocurrencies.

Common ground — and maybe a rivalry — for Donald Trump and Taylor Swift

With President-elect Trump named Time’s Person of the Year , Charles Passy asks a question about competition between Trump and Taylor Swift , who received the award last year.