News

What Happened in Crypto Today: Why Are the Bitcoin Whales Dumping?

Bitcoin just hit $106K.

You'd think after years of watching this market, we'd be used to these numbers by now. But there's something different about this rally.

While Bitcoin's out there breaking records, altcoins seem stuck. They're just... sitting there.

Usually when Bitcoin makes moves like this, the whole market turns into a green festival. But not today.

What's even more interesting is that this isn't a typical FOMO-driven surge. The market's surprisingly calm about it all - almost too calm.

So what's going on? Let's make sense of it all! Here is a quick rundown of the top headlines from the past 24 hours:

Before diving in, here’s a -

A Quick Market Analysis…

The crypto market continues to show its maturity as Bitcoin maintains its position above $100K, now reaching a fresh peak of $106K.

This sustained performance above six figures isn't just a quick spike - it represents a new baseline that's been holding strong for days.

Long-term holder behavior is telling an interesting story. According to Glassnode, there's a clear mathematical pattern at play: investors become 10x less likely to sell their Bitcoin for every 10x increase in holding time. And they are backing this theory with nearly a decade of data from 2015 to late 2024.

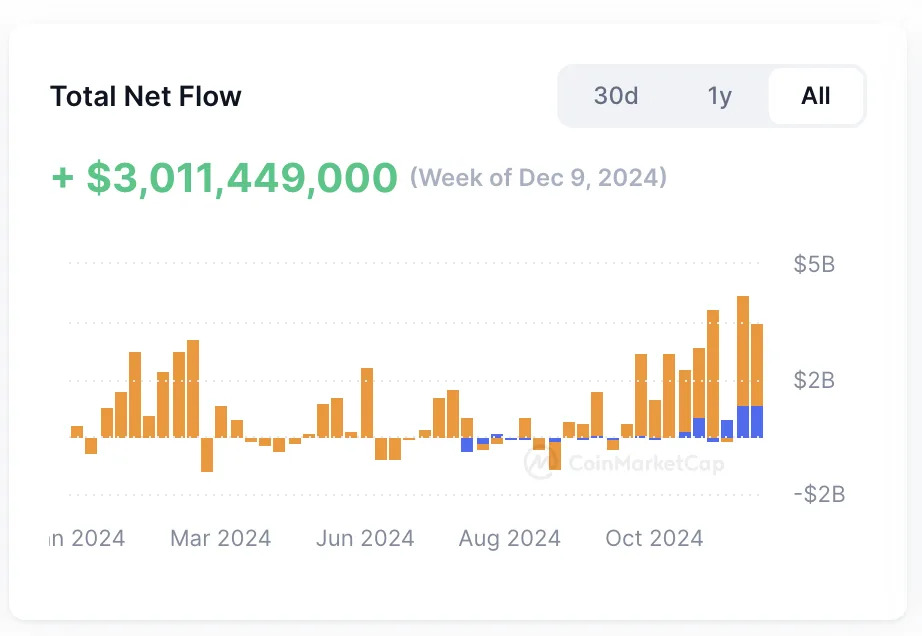

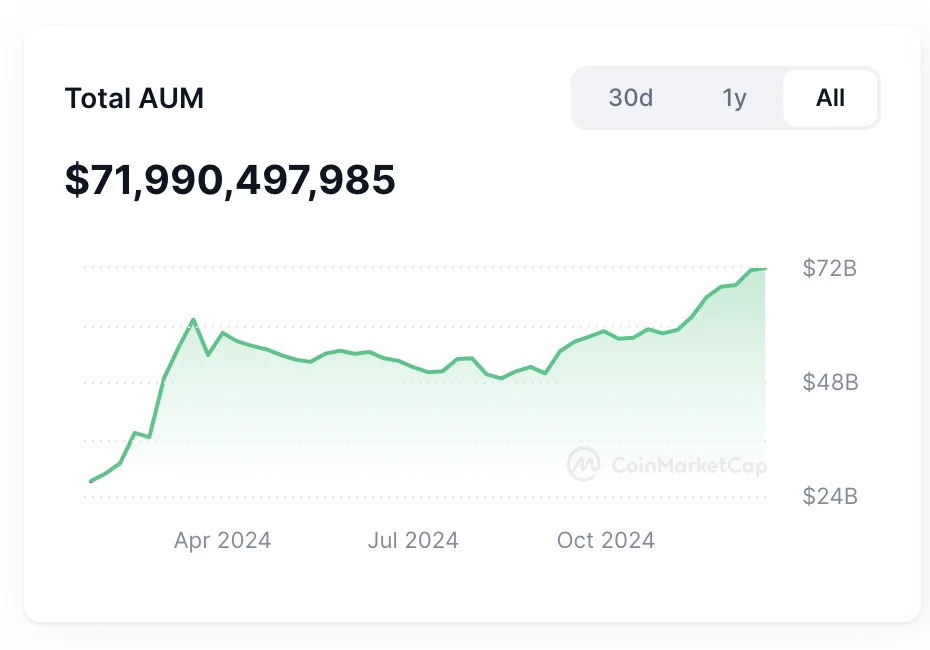

The January 2024 spot Bitcoin ETF approval fundamentally changed the game.

These ETFs have been consistently accumulating Bitcoin since their launch, showing that institutional investors are in for the long haul.

This steady institutional buying pressure is different from previous bull markets, which were primarily driven by retail.

The April 2024 halving has added another layer to this dynamic. While previous halvings have historically led to supply constraints, this is the first time we're experiencing one with significant institutional participation through ETFs. The combo of reduced mining rewards and institutional demand is creating a unique market environment we haven't seen before.

What Should You Do?

Based on the insights, focus on monitoring UTXO age distributions - they've proven to be remarkably accurate market indicators (not financial advice).

When evaluating market conditions, examine the balance between young and aged coins in circulation rather than focusing solely on price action. The research shows that coins held beyond 200 days exhibit distinct behavioral patterns, which can be valuable for timing your analysis.

Now let’s dive into news stories!

XRP's Next Big Move

A new stablecoin is about to shake up the XRP ecosystem in a major way.

RLUSD, approved by New York regulators, is launching on both XRP Ledger and Ethereum. But here's what makes it different - every transaction burns XRP tokens as fees.

Think about it. A fully regulated, dollar-backed stablecoin that constantly reduces XRP's supply.

But how long is it gonna take to launch it? Read the full story !

DOGE Holders Are Playing a Different Game

Bitcoin just hit $106,488.

The interesting part? It's the only top 10 cryptocurrency that's actually making gains this week - up 3% while others are slipping.

The market hasn't been kind lately. Nearly $200 million in trades got liquidated in the past day alone. But Bitcoin? It's standing strong, hitting new all-time highs.

Dogecoin is writing its own story at $0.403. The small investors are piling in - they've added about 40 million DOGE to their wallets since November. Meanwhile, the bigger players are quietly stepping back.

Wait, what? Read the full story !

The Little Fish Are Buying While Whales Cash Out - Here's What It Means

Building on the last news story, something fascinating is happening in the market right now. Small investors - those holding less than 1 BTC - are jumping in at record numbers, even with Bitcoin sitting at $101,720.

These "shrimp" wallets (yes, that's what degens calls them) have grown from 265,000 to 323,000 since Bitcoin was at $61,000. That's a 21.9% increase, and analyst Axel Adler thinks we'll see another 28,000 wallets joining in soon.

But here's the twist - while these smaller investors are buying, the whales are heading for the exit. Long-term holders just sold over 827,783 BTC in the past month.

What’s happening? Read the full story !

Ethereum's Price May Do Something Big

Ethereum's been pretty quiet lately, hanging around $4,000 while Bitcoin's been stealing the show with its $100,000 milestone. But something interesting is brewing under the surface.

The numbers tell an intriguing story.

Bitcoin jumped 54% in six months, while Ethereum only managed a 12% gain. That's unusually low for crypto's second-in-command.

But Ethereum's creating over 130,000 new wallets daily this December. That's the highest number we've seen in eight months.

But why are so many new wallets popping up right now? Read the full story !

Major Crypto Policy Group Gets New Leadership as Trump Era Approaches

A big shift is happening at the Crypto Council for Innovation, the organization that's been pushing for sensible crypto rules in Washington.

Sheila Warren, who's been steering the ship for three years, just announced she's stepping down as CEO in January 2025.

Warren's exit comes right as the crypto industry is gearing up for what many believe could be a major regulatory overhaul under the Trump administration.

So what's really behind this leadership change? And how might it affect crypto's relationship with Washington? Read the full story !