News

LTL stocks sag on Q4 updates

Shares of less-than-truckload carriers were lower Tuesday after two companies provided fourth-quarter updates. The updates likely reflect the bottom of the cycle, the point where carriers are in need of more volume, or an improved freight mix, moving through their high fixed-cost networks.

ArcBest ( NASDAQ: ARCB ) was down 1.6% at 11:19 a.m. EST while shares of Saia ( NASDAQ: SAIA ) were down 2.7%. The S&P 500 was down just 0.1% at the time.

ArcBest’s network needs more freight

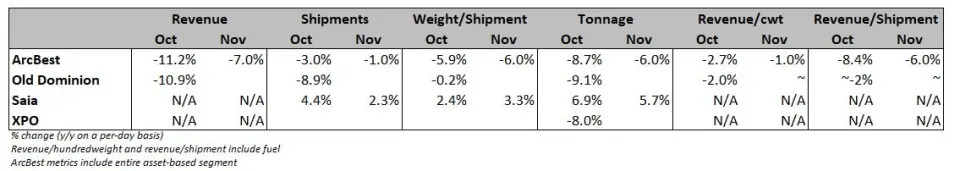

ArcBest’s asset-based unit, which includes results from LTL subsidiary ABF Freight, recorded a 7% year-over-year decline in revenue per day during November as tonnage fell 6% and revenue per hundredweight, or yield, declined 1%. The tonnage decline was the result of a 1% dip in shipments and a 6% drop in weight per shipment.

The November result was an improvement from an 11.2% y/y revenue decline in October (tonnage down 8.7% and yield down 2.7%), but that month was up against a much tougher comp.

Many LTL carriers benefited from a cyberattack at private carrier Estes in October 2023, which, ArcBest said in a Tuesday filing with the Securities and Exchange Commission, drove “increased business at higher prices.”

On a two-year-stacked comparison, ArcBest’s tonnage was down 12.7% in October and 15.6% in November. Both numbers are an improvement from the cycle low in May (down 20.4%).

ArcBest began swapping out transactional freight, which it took on early in the freight recession to keep the network full, with higher-yielding freight from contractual customers just ahead of Yellow Corp.’s ( OTC: YELLQ ) July 2023 shutdown . A lack of those higher-quality shipments in this market, however, remains a headwind.

The company’s y/y comps ease materially in the first half of 2025.

ArcBest said November results were negatively impacted by “continued weak industrial production” and as the industry has lost “higher-weight LTL shipments” to the truckload market where capacity is plentiful and rates remain low.

Lower shipment weights have been propping up the yield metrics although the company said in the filing that “LTL pricing remains rational.” It also said yields were up by a low-single-digit percentage excluding the impact from lower fuel surcharges.

The company reported a 4.6% increase on contractual price renewals in the third quarter and said a month ago that its 5.9% Sept. 9 general rate increase was seeing “really good retention.”

Quarter to date, ArcBest’s asset-based revenue per day is down 9% y/y and worse than management’s guidance for a mid-single-digit decline. However, the filing said the per-day declines “moderated in November” and the company reiterated the guide.

Revenue per day was down 5.8% y/y in the third quarter.

The asset-based operating ratio (inverse of operating margin) normally deteriorates 100 to 200 basis points from the third to the fourth quarter. ArcBest reiterated prior guidance to be at the high end of that range this year. That implies a 93% OR, 530 bps worse y/y.

ArcBest’s asset-light unit, which includes truck brokerage operations, reported a 6% y/y decline in revenue per day during November. Shipments per day were flat but revenue per shipment was off 6%. The company noted “decreased demand from existing customers” and its “strategic reduction in less profitable truckload volumes” as the culprits. It also pointed to an increase in managed transportation, where shipments (and revenue per shipment) are smaller.

Asset-light trends have improved from October when revenue per day was down 13.6% y/y. The company reiterated guidance for a $5 million to $7 million adjusted operating loss in the unit during the fourth quarter.

Saia continues to take market share, Wall Street eyes margin impact

Saia reported a 5.7% y/y increase in tonnage during November and modestly revised its October tonnage result to a 6.9% increase. Shipments in November were up 2.3% and weight per shipment was 3.3% higher. Shipments were up 4.4% in October with weight per shipment 2.4% higher.

The carrier’s two-year-stacked comps show tonnage growth of almost 15% for both months. The carrier’s y/y comps have become more formidable as the industry has lapped Yellow’s exit. The October 2024 comp also had the headwinds from the prior-year outage at Estes and the fallout from two major hurricanes.

Saia has been actively taking market share to fill the 28 terminals it acquired from Yellow . The company has also made some organic acquisitions and relocated operations into larger, better-located sites.

Saia doesn’t provide yield or pricing metrics in its intraquarter updates.

Saia previously said the newfound volumes have resulted in an inferior freight mix, pressuring margins. However, the company said on its third-quarter call in late October that it expects to outperform seasonal OR deterioration of 250 bps from the third to the fourth quarter even as it contends with incremental operating costs associated with opening and relocating terminals.

Assuming a 50-bp outperformance, the carrier would generate an 87% OR, 200 bps worse y/y.

The Tuesday updates also dragged down shares of Old Dominion Freight Line ( NASDAQ: ODFL ) and XPO ( NYSE: XPO ) by 2.5% and 1.4%, respectively. The two companies are expected to provide fourth-quarter updates this week.

More FreightWaves articles by Todd Maiden :

The post LTL stocks sag on Q4 updates appeared first on FreightWaves .